Are you 70 ½ years of age?

Will you be soon? Does your savings portfolio include an IRA? Want to donate to your favorite marching band AND lower your taxes? At the same time?

The UMMB has funding opportunities waiting for you, ranging from the Band Alumni Scholarship endowment to annual funds that expand the band’s ability to travel and purchase instruments.

Here’s how… but please talk to your financial advisor.

An individual retirement account, more commonly referred to as an IRA, is a good place to save for your retirement. Once you reach a certain age, though, you’ll have to start taking a minimum amount out of your account each year, called a required minimum distribution (RMD).

You must take out your first required minimum distribution by April 1 of the year after you turn 70 ½. For all subsequent years, you must take the money out of your accounts by December 31. The IRS requires that you do this ANNUALLY!

Refer to IRS publication 590-B for details.

You can make Qualified Charitable Deductions (QCD) direct transfers from your IRA. Best of all, you can donate up to $100,000 annually TAX FREE!

What’s Your Tax Bracket?

Has your IRA RMD put you into a higher tax bracket? Contribute up to $100,000/year from an IRA to a qualified charity (hint, hint… the Minuteman Band!) to lower your adjusted gross income. State income taxes and Medicare premiums are lowered, too!

Features & Benefits

- Reduce your annual taxes – both federal and state

- Enjoy tax benefits

- Exclude income from your tax return – save on Medicare premiums

- Still use the FULL standard deduction

- Do good! Enjoy your giving!

Running the Numbers

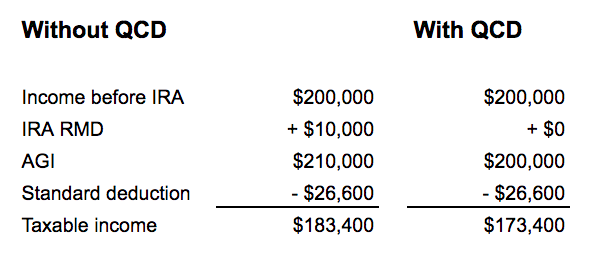

See how a $10k QCD could help a couples’ taxes. Both spouses older than 70 ½ and file joint return.

Taxable difference $10,000 X tax rate of 24% = tax savings of $2,400.

Special thanks to Minuteman Band patron Jim Parker ’67 for putting this information together!